By Dan Steinbock

The resurgence of COVID-19 in the United States is paving the way to a debt record, even relative to government debt at the end of World War II. The collateral damage in global recovery will be significant.

The resurgence of COVID-19 in the United States is paving the way to a debt record, even relative to government debt at the end of World War II. The collateral damage in global recovery will be significant.

The delays and containment failures of the COVID-19 in major advanced economies, particularly the United States, are morphing into a faster-than-expected series of economic challenges, including debt crises.

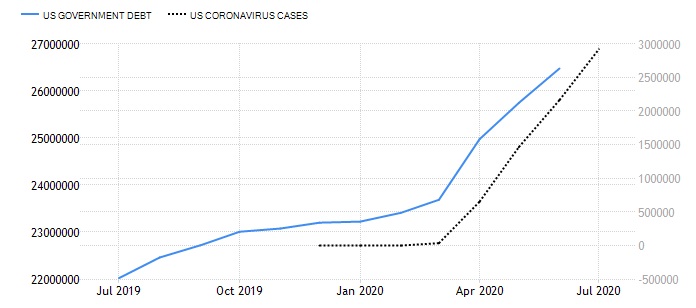

Only two quarters ago, US federal debt hovered around $23 trillion; a stunning 106% as percentage of the GDP. Today – after barely two quarters – that debt is close to $27 trillion (Figure 1). Moreover, as US GDP has drastically contracted, the debt-to-GDP ratio is now closer to 133%; higher than that of Italy in 2018, or Greece prior to its debt crisis in 2010.

But unlike Italy or Greece, US is one of the global anchor economies. Consequently, spillover effects will ensue. Furthermore, both US government debt and the debt-to-GDP ratio will continue to climb.

Figure 1 US Government Debt and US Coronavirus cases

Failures in COVID-19 containment translates to…

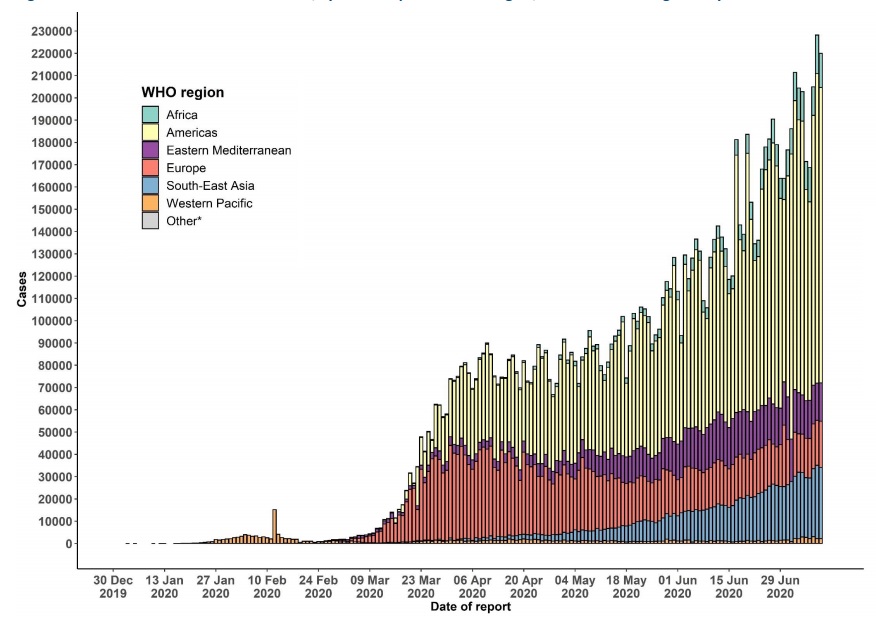

In early spring, the epicenter of the COVID-19 moved to Western Europe. Then, it exploded in North America. Today, it is rapidly spreading in emerging and developing economies, while accelerating in the United States, again.

The spread in poorer economies was widely expected; the resurgence in the US was a concern, but mainly in late fall 2020 or early spring 2021. Now it is a reality.

The reasons are well known: Despite knowledge about the new coronavirus already on January 3, the Trump administration did not mobilize against it. When the WHO launched its international alert on January 30, that did not result in effective mobilization either. After the WHO finally issued the pandemic alert, the Trump White House began mobilization, but belatedly and ineffectively.

Due to poor crisis leadership and premature exits, the administration is now struggling with the COVID-19 resurgence, while similar failures and spillovers have turned the Americas into the largest regional COVID-19 epicenter (Figure).

Figure 2 Confirmed COVID-19 Cases by Regions, through July 11, 2020

Source: WHO

Source: WHO

There was nothing inevitable about this trajectory. In January, first virus cases surfaced in both the US and Canada. The former delayed an effective response; the latter mobilized more effectively. By mid-July, US will have close to 3.5 million cases and almost 140,000 deaths; in Canada, the comparable figures are likely to remain lower than 110,000 and below 9,000, respectively.

Due to the central role of the US in the global economy, the pandemic failure will severely compound collateral economic damage – including the coming debt crises.

Federal debt surpassing WWII record

In the past two quarters, the early economic defense has been by the major central banks to cut down the rates, inject liquidity and re-start major asset purchases. Moreover, a rare bipartisan consensus allowed the Congress to pass the $3 trillion stimulus to avoid a more severe collapse in the spring. But another package will be needed later in the summer.

Once again, major advanced economies are hoarding new debt to defuse short-term economic challenges, which will drastically worsen their longer-term debt challenges.

Following the 2008 contraction, US debt-ceiling crisis climaxed in fall 2011. That’s when federal debt was still $14 trillion; now it has almost doubled (!) to $27 trillion.

At the end of World War II, US federal debt-to-GDP ratio was almost 120%. Thanks to the secular growth potential in the US and global recovery, it was reduced relatively fast. Today US debt-to-GDP ratio – if real-time data were to be included – has likely surpassed the wartime record, but in peacetime conditions (Figure).

Figure 3 US Federal Debt surpasses WWII record

US economy was in secular stagnation already before the coronavirus contraction. Consequently, it lacks long-term growth potential to reduce that debt. Moreover, the volume of federal debt will continue to climb, and so will the debt-to-GDP ratio.

What are some of the effective implications?

The great coronavirus contraction just got worse

Only a few weeks ago, I projected US second-quarter decline to be a historical -33%. Now, thanks to the COVID-19 resurgence, that contraction could be closer to -53%.

Prior to the COVID-19 resurgence, many observers hoped that US economy had bottomed out in May, which would have kept the full-year contraction at about 5.0%. That’s no longer in the cards. In reality, the plunge could amount to -8% to -9%.

Thanks to the pandemic resurgence, US recovery is likely to prove slower than anticipated. Not only will the recovery linger, it is likely to prove more fragile than anticipated, due to concerns for new COVID-19 waves in the fall and uncertainty about when an effective vaccine, therapies, or both will be available.

Those who hoped US unemployment would remain below 8% may be frustrated. The lingering recovery may keep unemployment rate close to 9% at the year-end, and it may not return to pre-crisis levels until the end of 2023; if even then. In a downside scenario, it would remain closer to 10% in 2020 and improve more slowly.

Despite the jobs liftoff in May, some 20 million jobs have been lost since the pandemic. Many of those jobs may be gone. And since small businesses, which have benefited from the new PPP (Paycheck Protection Program) loans, are obligated to rehire only 60% of their pre-crisis workforce, adequate incentives for full employment are missing.

Thanks to the misguided trade wars plus the coronavirus contraction, trade volumes have collapsed. In turn, a new flare-up of trade tensions – since President Trump has now ruled out a Phase 2 truce – will suppress private investment. That, in turn, will penalize business and residential investment severely

Yet, there was nothing inevitable in the current trajectory that heralds a historical debt crisis in America. It was paved with policy mistakes and unipolar arrogance. It could be corrected with right policies and multilateral cooperation.

No comments:

Post a Comment