Julie Zhu

HONG KONG, Dec 13 (Reuters) - China is working on a more than 1 trillion yuan ($143 billion) support package for its semiconductor industry, three sources said, in a major step towards self sufficiency in chips and to counter U.S. moves aimed at slowing its technological advances.

Beijing plans to roll out what will be one of its biggest fiscal incentive packages, allocated over five years, mainly as subsidies and tax credits to bolster semiconductor production and research activities at home, said the sources.

It signals, as analysts have expected, a more direct approach by China in shaping the future of an industry which has become a geopolitical hot button due to soaring demand for chips and which Beijing regards as a cornerstone of its technological might.

It will also likely further raise concerns in the United States and its allies about China's competition in the semiconductor industry, say analysts. Some U.S. lawmakers are already worried about China's chip production capacity build-up.

The plan could be implemented as soon as the first quarter of next year, said two of the sources who declined to be named as they were not authorised to speak to media.

The majority of the financial assistance would be used to subsidise the purchases of domestic semiconductor equipment by Chinese firms, mainly semiconductor fabrication plants, or fabs, they said.

Such companies would be entitled to a 20% subsidy on the cost of purchases, the three sources said.

The fiscal support plan comes after the U.S. Commerce Department passed in October a sweeping set of regulations, which could bar research labs and commercial data centres' access to advanced AI chips, among other curbs.

The United States has also been lobbying some of its partners, including Japan and the Netherlands, to tighten exports to China of equipment used to make semiconductors.

And U.S. President Joe Biden in August signed a landmark bill to provide $52.7 billion in grants for U.S. semiconductor production and research as well as tax credit for chip plants estimated to be worth $24 billion.

With the incentive package, Beijing aims to step up support for Chinese chip firms to build, expand or modernise domestic facilities for fabrication, assembly, packaging, and research and development, the sources said.

Beijing's latest plan also includes preferential tax policies for the country's semiconductor industry, they said.

China's State Council Information Office did not respond to a request for comment.

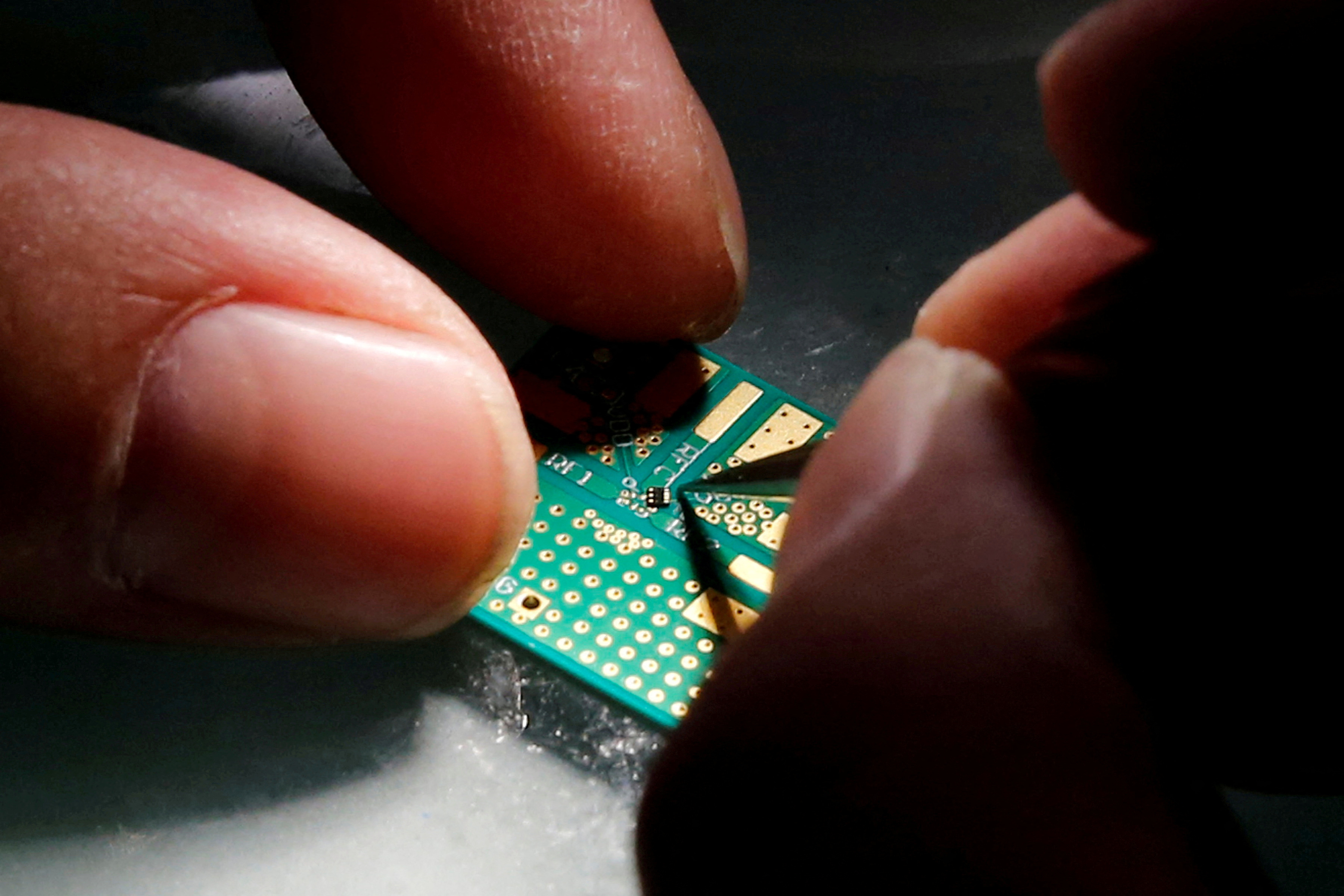

A researcher plants a semiconductor on an interface board during a research work to design and develop a semiconductor product at Tsinghua Unigroup research centre in Beijing, China, February 29, 2016. REUTERS/Kim Kyung-Hoon/File Photo

LIKELY BENEFICIARIES

The beneficiaries will be both state-owned and private enterprises in the industry, notably large semiconductor equipment firms like NAURA Technology Group (002371.SZ), Advanced Micro-Fabrication Equipment Inc China (688012.SS) and Kingsemi (688037.SS), the sources added.

Stocks of Chinese chipmakers jumped in early trading on Wednesday after news of the package. China's SSE STAR Chip Index (.STARCHIP) opened nearly 4% higher. Shanghai-listed shares of industry giant Semiconductor Manufacturing International Corp (SMIC) rose as much as 5.2% to a four-month high.

Some Chinese chip shares in Hong Kong also rose sharply on Tuesday following the Reuters report. SMIC (0981.HK) added more than 8%, sending its daily gain to nearly 10%. Hua Hong Semiconductor Ltd (1347.HK) closed up 17%. Mainland markets were closed when the report was published.

Achieving self-reliance in technology featured prominently in President Xi Jinping's full work report at the Communist Party Congress in October. The term 'technology' was referred to 40 times, up from 17 times in the report from the 2017 congress.

Xi's call for China to "win the battle" in core technologies could signal an overhaul in Beijing's approach to advancing its tech industry, with more state-led spending and intervention to counter U.S. pressures, analysts have said.

The U.S. sanctions published in October have caused major overseas-based chip manufacturing equipment companies to cease supplying key Chinese chipmakers, including Yangtze memory Technologies Co (YMTC) and SMIC, and makers of advanced artificial intelligence chips to cease supplying companies and laboratories.

The world's second-largest economy has launched a trade dispute at the World Trade Organization against the United States over its chip export control measures, China's commerce ministry said on Monday.

China has long lagged the rest of the world in the chip manufacturing equipment sector, which remains dominated by companies based in the United States, Japan, and the Netherlands.

A number of domestic firms have emerged in the past 20 years, but most remain behind their rivals in terms of ability to produce advanced chips.

NAURA's etching and thermal process equipment, for example, can only produce 28-nanometer and above chips, relatively mature technologies.

Shanghai Micro Electronics Equipment Group Co Ltd (SMEE), China's only lithography company, can produce 90-nanometers chips, well behind that of the Netherlands' ASML, which is producing those as low as 3 nanometers.

No comments:

Post a Comment